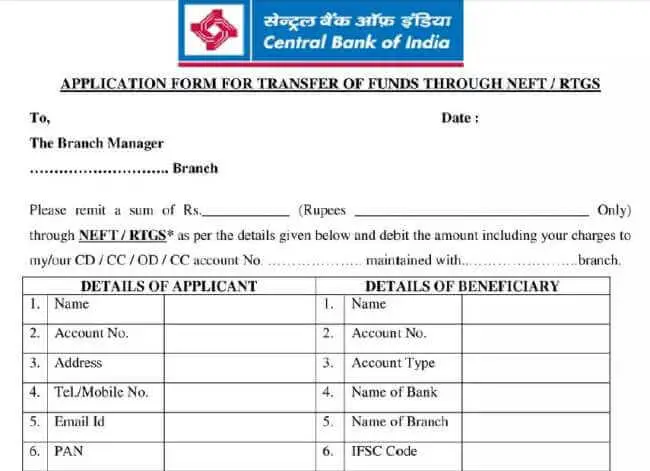

The Indian Central Bank, download it. RTGS/NEFT Pdf Form: One bank that accepts RTGS and NEFT payments is the Central Bank of India. RTGS and NEFT are two customer-provided fund transfer solutions.

RTGS form of Central Bank of India

In this case, the RBI is in charge of managing RTGS (Real Time Gross Settlement). National Electronic Funds Transfer, on the other hand, goes by the acronym NEFT.

NEFT form of Central Bank of India

There is no maximum limit for RTGS, but there is a minimum of INR 2 lakhs. For NEFT transfers, however, there is neither a lower nor upper limit.

Download the RTGS/NEFT PDF Form from Central Bank of India. Typically, you may obtain an RTGS/NEFT form directly from the bank branch. But, you can download it online instead of going to the branch. You must access the bank’s website to download the form. The CBI RTGS/NEFT form can be downloaded directly from this URL.

Central Bank of India RTGS/NEFT Charges

RTGS charges:

- Branch interface

- Inward RTGS: No charges

- Outward charges

- From INR 2 lakhs to 5 lakhs: INR 24.50

- More than 5 lakhs: INR 49.50

- Via Digital Banking

- Till INR 10,000: No charges

- More than INR 10,000 to INR 5 lakhs: INR 4.50

- More than INR 5 lakhs: INR 10

NEFT charges:

- Branch interface

- Inward NEFT: No charges

- Outward NEFT

- Till INR 10,000: INR 2.50

- More than 10,000 but till INR 1 lakh: INR 5

- Above 1 lakh but till INR 2 lakhs: INR 15

- More than 2 lakhs: INR 25

- Via Digital Banking