How do I complete the SBI Bank KYC Form? SBI KYC Form Online Application, How to Fill SBI Bank KYC Form? That is, if your bank account is with SBI, you should be aware that it is critical to complete KYC at any bank and that if you do not want your account to be banned, you must complete SBI KYC Form, which we have provided below. How to perform KYC has been explained in simple stages.

SBI KYC Form

If the bank is digital or traditional, you must provide certain crucial papers everywhere, and this media is now known as KYC. Nonetheless, many people are still unaware of what KYC is. What is its complete name? So, first, let’s learn a little about it, and then we’ll learn how to conduct SBI account KYC.

SBI KYC Update Form

KYC is an abbreviation for “Know Your Client.” In layman’s terms, it means “Know or identify your consumer.”

SBI केवाईसी अपडेट फॉर्म

What is KYC ?

What exactly is KYC? We will demonstrate this by using a simple example: if we go for a JOB INTERVIEW in a firm, we are not picked without our awareness; the interviewer (interviewer) asks us certain questions.

- What is your name?

- What is your date of birth?

- What is your father’s name?

In which, in addition to our qualifications and work experience, we offer personal information. We are only chosen after part of our information has been taken from us.

The KYC process is also relatively comparable. Only here do we need to provide personal information relating to our bank rather than our work experience and qualifications. KYC is required for us to create a bank account or reactivate our suspended account.

Almost all banks have made it essential to fill out KYC forms as of today. If a consumer establishes an account with a private or government bank, he must verify his papers within a particular time frame or the account may be temporarily banned. Today we will learn how to fill out the KYC Form in an SBI Bank Account.

How to fill KYC Form in SBI Bank Account?

At this time, we can submit our documents offline i.e. by taking our documents to the bank branch office and fill the form there and get the documents verified or else we can fill the KYC form from smartphone or laptop sitting at home and apply for verification.

Like other forms, it is a white colored form, in which we have to fill the information given in front of the small boxes. We can fill it online or offline as well. What information is required to be given? Let’s know in detail

Passport Size Photograph

- Branch (Branch): We must mention about the area/location where our bank is located. For example, if someone’s bank is in Andheri, Mumbai, the branch is also in Andheri.

- CIF number (CIF number): Customer Information File is its full name. SBI Bank’s CIF number is 11 digits long. That is just written in our bank’s pass book.

- Account No (Account Number): Here we must enter our bank account number.

- Name: We must write our entire name here.

- Birth Date: – In this section, we must write our birthdate, including the month and year.

- Residential Situation: We are offered certain alternatives to check, such as Resident Individual, Non Resident Individual, Foreign National, and so on. If your place of residence is solely in India, you must check the box for Resident Person.

- Kind of Occupation (Business): – You must select an option in the field in which you conduct business or work. Private sector, public sector, self-employed, student, and so forth. You must select one of these options.

- Yearly income (earnings / income): In this section, we must provide our annual revenue, often known as earnings.

- PAN (Personal Identification Number): In this field, we must provide our PAN number.

- Document number:- We must leave this column blank. Aadhar Card Number (Aadhar No.):In this section, we must provide the Aadhar card number.

- Current/Local Address: – In this section, we must specify the address of where we reside. In which, in addition to our home address, we must include information about our town / city, district (district), pin code, and state.

- Contact Information (Contact Details): We must include our phone number or cell number here.

- Email Id: – If you have an email address, enter it here. (It is not required; you may leave it blank.)

- Date: Choose the date you wish to submit the KYC FORM.

- Signature: – This is where we must sign.

Apply Online For SBI KYC

If you want to undertake Online KYC verification, then follow the steps outlined below and complete your verification while sitting at home. Just remember to double-check the form before submitting it.

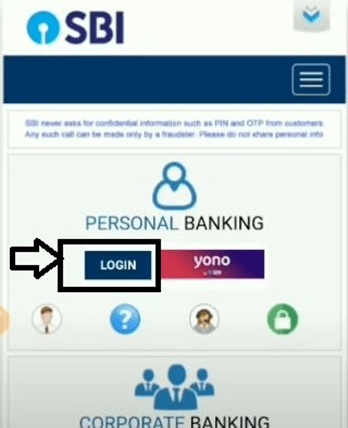

Step 1: Go to www.onlinesbi.com and click on login.

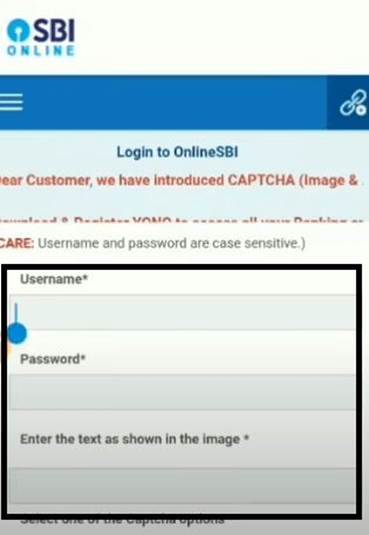

Step 2: Enter your net banking ID and password.

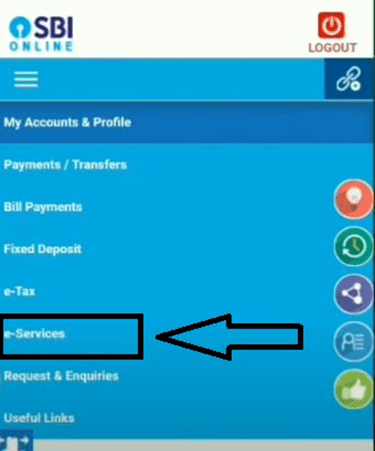

Step 3: After logging in, navigate to the website’s menu and select eServices.

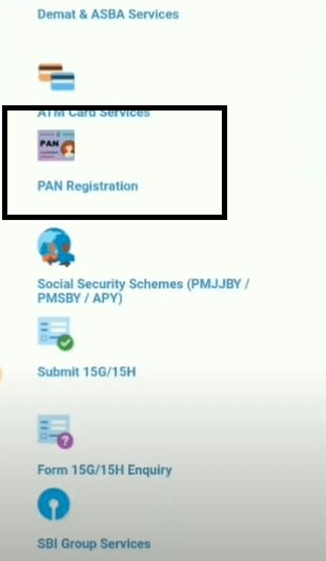

Step 4: You will be presented with other alternatives, but you must select PAN Registration.

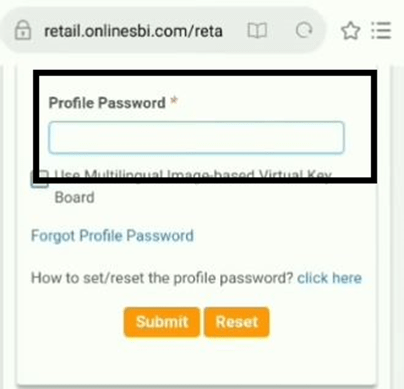

Step 5: Enter the Profile password again and then click Submit.

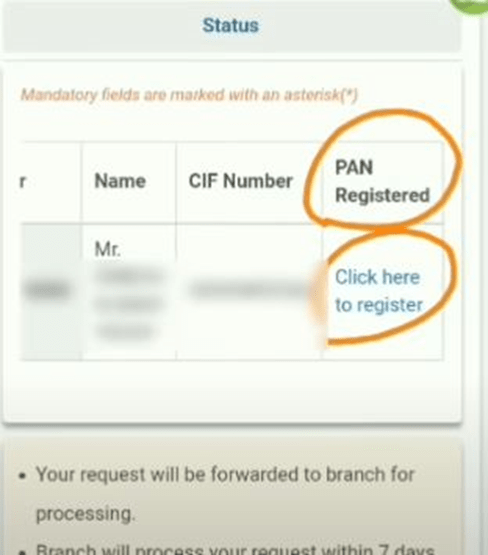

Step 6. Now you have to create a request for PAN registration and for this click on Click here to register.

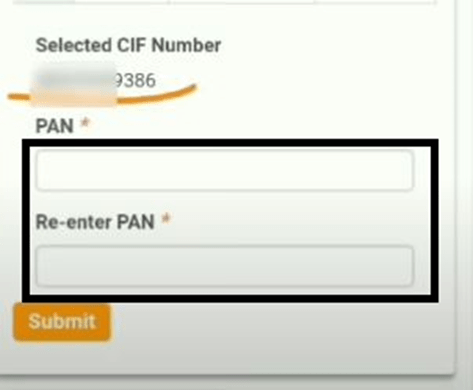

Step 7. Now, input your PAN number and press the submit button.

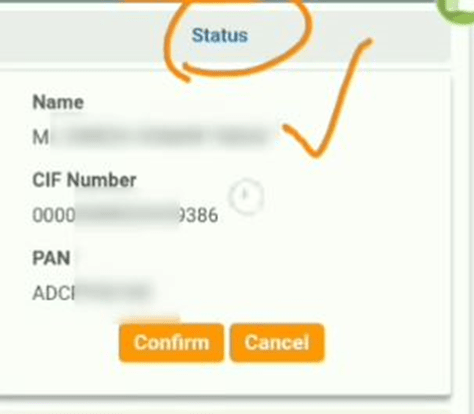

Step 8: Once you’ve verified that all of the information is right, click the confirm button.

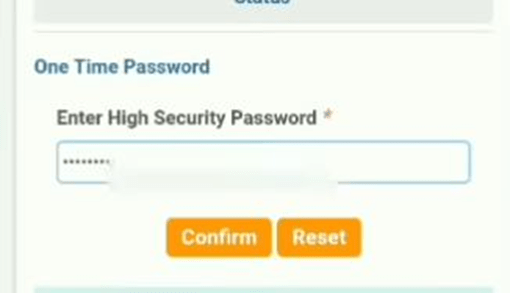

Step 9: On the final step, you must verify the OTP, after which your information will be successfully submitted.

Friends, you may now finish your SBI bank KYC procedure from the comfort of your own home. But, if your cellphone number is not connected with your bank account and you do not have a net banking account, you will need to travel to the bank and have the information checked there. Please share your thoughts on this topic in the comments section.